The Rye City School Board suffered a sharp reversal in December when its proposed $20 million bond issue to fund new classroom space, and other renovations to the high school, was soundly defeated. A well-orchestrated campaign by the Committee for Strong Sustainable Schools, headed by former mayor Edward B. Dunn, led the opposition.

The School Board responded in January by acknowledging the need to limit the rate of tax increases in order to gain community support. In a report to the Board, School Superintendent Dr. Edward Shine said the December issue failed in part because, “The projected tax increases… were too large over the next five years.” Further, he noted “tax increases that stay within the new [2%] tax cap,” needed to be considered.1

|

1See: Shine, Edward J., “A Recap of the Capital Project and Bond Vote”, Rye City School District (January 2012), 2. |

|

|

7The table below sets forth the budget increases between the 2011-12 approved budget and the 2015-16 baseline case, by category. |

|

|

|

8Interview with Laura Slack, President Rye City School Board of Education; Ray Schmitt, Vice President Rye City School Board of Education; and Kathleen Ryan, Assistant Superintendent for Business Rye City School District, on February 9, 2012. |

By Dod A. Fraser

The Rye City School Board suffered a sharp reversal in December when its proposed $20 million bond issue to fund new classroom space, and other renovations to the high school, was soundly defeated. A well-orchestrated campaign by the Committee for Strong Sustainable Schools, headed by former mayor Edward B. Dunn, led the opposition.

The School Board responded in January by acknowledging the need to limit the rate of tax increases in order to gain community support. In a report to the Board, School Superintendent Dr. Edward Shine said the December issue failed in part because, “The projected tax increases… were too large over the next five years.” Further, he noted “tax increases that stay within the new [2%] tax cap,” needed to be considered.1

After a series of meetings with the School Board and District leadership, the Committee for Strong Sustainable Schools announced last week that they will not oppose the revised $16 million bond issue scheduled for a vote in March.

In an interview with The Rye Record, Mr. Dunn said the Schools Board’s “firm intention” to limit tax increases to no more than 2% over the next five years was “fundamental” to the Committee’s decision to not oppose the revised bond issue.2

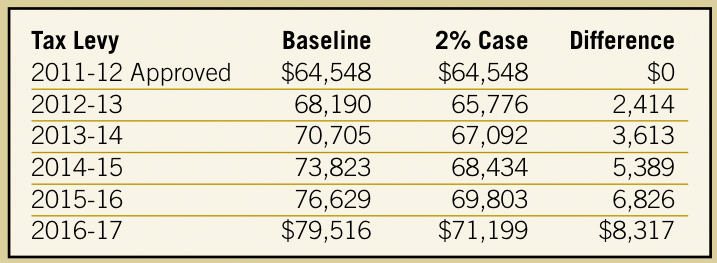

What does this mean for future budgets? The business-as-usual baseline case prepared for the Board last fall showed the school tax levy increasing by 23% the next five years.3

If increases are held to 2% a year, the total increase will be 10%.4

The baseline case assumes all school programs continue, teachers are hired to accommodate increased enrollment, class sizes remain the same, salary and benefit costs continue at not less than current contract rates, and includes conservative projections of pension and other cost increases.5

If the tax levy is held to a 2% annual increase, the 2015-16 expenditures will need to be cut by $8,300,000, over 10%. And, many millions will need to be cut each year before that. This is a huge challenge for the Board. 6

Where can the Board find cost cuts of this magnitude without gutting the educational opportunities for Rye students?This report posits that there are only three budget areas where savings of this magnitude can be found. One is not within the Board’s control: pension expense dictated by the State. Two are within the Board’s control; voters can expect the Board to consider options that:

- Limit the growth in teacher and other staff compensation, and

- Limit the number of teachers and other staff by selectively increasing class sizes or eliminating programs.

We will address these budget categories in turn, but first let us address the other areas of the budget and why a solution cannot be found with them.

Expenses other than Pensions and

Teacher Compensation

The baseline case calls for the tax levy to increase from $64.5 million in 2011-12 to $79.4 million in 2016-17, or $14.9 million. The total of all increases other than compensation and pensions is nil. Some program costs increase, such as special education, but others decline. Effectively, all the expense increase is accounted for by the three budget categories noted above: what we pay the teachers, the number of teachers, and pensions.7

Does this mean no other costs can be reduced? Board President Laura Slack said the baseline case is: “What would happen if the Board took no action, but the Board intends to take action.”8

Reserves also can be used to reduce the rate increase. Indeed, the initial budget proposal for 2012-13 is to use up to $2 million in reserves to keep the tax rate increase below 2% and the use of an additional $500,000 in reserves for miscellaneous capital improvements. There are limits, however, to the use of reserves.9

The Rye City School District had $13.8 million in reserves at June 30, 2011. Kathleen Ryan, Assistant Superintendent for Business, noted in an interview that prudence and debt rating requirements suggest reserves should be maintained at 15 to 20% of the annual expense budget—or about $10 to $15 million for Rye.10 So, while reserves can be used to step the district into a cost reduction program, they cannot be used in lieu of cost reductions.

Changes in other revenue sources, such as State aid, are not large enough to have a material effect.

A Primer On PayThere are eight principal components to a Rye teacher’s compensation, so it is easy to get confused unless you have a scorecard. Here is the scorecard: Base Salary Each teacher receives a base salary. Under the current contract the starting salary for a new teacher with a bachelor’s degree is $54,229; the starting salary for a new teacher with a Master’s degree is $60,356; the starting salary for a PhD is $69,250. After 12 years of service the salaries are: $81,342; $90,074; and, $107,048, respectively.13 “Steps” Based on Years of Service Each year a teacher’s base salary is increased. After eighteen years, the Step increases based on service stop and are replaced with more modest longevity credits. Thus, the teachers with the longest tenure find their salary increases limited relative to younger faculty. Under the current contract the Step increases based on service average 3.5 percent a year.14 “Steps” Based on Degree and Professional Development Credit Level Teachers can increase their base salary by getting an advanced degree and by taking professional development courses. Under the current contract there are eight or nine salary grades depending on degree and professional development credits ranging from B.A. to Ph.D. and when the teacher started. The average increase in base salary by moving from one grade to the next is 3.4%.15 Health Care The district pays health care premiums for each teacher; the average annual premium for a family plan is approximately $20,000 a year.16 The teacher pays a portion of the premium; the teacher contribution will be 15% of the premium by the end of the current contract.17 This compares to 28% average contributions for covered workers with family plans in private industry.18 Pension A statewide retirement program covers the teachers. The state legislature and governor set the terms of the program by law; the school districts fund the plan. It is a defined benefit plan (that is the pension benefit is set without regard to the investment performance of the assets that fund the plan; contributions to the plan vary so that enough money is available to pay all retirement benefits). In general, the current plan allows retirement at age 55 and pays 60% of average final salary for those with 30 years of service.19 This past year, the district was required to contribute 11.5% of salaries into the State managed retirement fund.20

Social Security and Medicare Taxes The district pays the employer share of Social Security and Medicare taxes, just like any employer in the private sector. The combined rate is set by the Federal government and currently is 7.65% of salary. “Across-the-Board” Increases The teacher’s contract generally provides for annual “across the board” increases in the salary schedules. These increases bump the base salaries for each of the years covered by the Steps based on service and Steps based on degree or professional development. And, because pension, Social Security taxes and Medicare taxes are calculated off salary, they too increase. |

Costs from Albany

The Board and Administration have repeatedly and vigorously complained about unsustainable costs pushed down on school districts by the legislature in Albany. Pension expense is the big one. By 2015-16 the base case has Rye paying $9.3 million into the State pension systems—over twice what the district pays today.

In addition, State legislators have repeatedly passed laws that require schools to provide specific services without providing the funding. Such unfunded mandates and pension expenses are outside the control of the Board.

Suzi Oppenheimer and George Latimer represent Rye in Albany on such matters. Continued pressure on them, and their successors after the next election, to stop unfunded mandates and reform the public pension system may provide some relief in this budget category.

Yet, pension and mandate relief will not fill the $8.3 million hole. If there were no increase in pension costs, the budget hole would still be approximately $4 million.

Teacher CostsThe largest budget item for the school district is compensation expense. The baseline case has compensation (excluding pensions) increasing by $8.5 million by 2015-16. Limiting these increases will be key in keeping tax rate growth at or below 2% annually.While administrative and other staff may be able to be trimmed on the margin, the real money comes from either limiting teacher compensation or the number of teachers. Teachers represent approximately 80% of total compensation expense.11

In August 2009 this paper published a comprehensive study of teacher incomes in Rye. The study showed, over the prior 18 years, the typical teacher’s salary increased at over twice the rate of median household incomes in Rye.12

The article noted there were clear signs that the Rye community no longer supported ever-increasing teacher compensation, certainly at rates that far exceed gains in their own income. The December defeat of the bond issue is yet another sign. Negotiations on a new teachers’ contract will commence in the fall. The last contract negotiations were lengthy and contentious and the Board made significant improvements in contract terms. Yet, to respond to the community’s message on the rate of tax increases, the Board will likely need to improve even further with the next contract. This may mean limiting or eliminating any “across-the-board” increases; further reducing automatic increases in the “STEP” schedules; and, requiring increased contributions by teachers for health care or other benefits. For those confused by the acronyms and the complexities of the teachers’ contract, consult the “Primer on Pay” from the August 2009 article.Of course, compensation expense increases can be also limited by having fewer teachers. This could lead to changes in program and/or increased class sizes.The effect on student performance of class size has been the subject of extensive debate within the education community. It is beyond the purview of this article to recap that debate at this time but no doubt, given the budget pressures on the Board, increased class size and trimming program offerings are likely to be considered and weighed against potential effects on student achievement.In this regard, to the extent the Board is able to reach a favorable settlement with the teachers’ union next fall, more programs can remain and class sizes can be smaller.

Conclusion

The community has sent a clear message to the School Board on the acceptable rate of tax increases. The new tax cap law increases the power of the electorate for increases over 2% require a 60% super-majority to pass in the budget elections. Organized and effective opposition has also emerged with groups such as Committee for Strong Sustainable Schools, and it is likely to remain.

It will serve Rye’s interests best and it will serve the students in the Rye best if the Board, administration, parents, teachers, and community engage constructively in a dialogue on how to best match the community’s willingness to bear tax increases with the aspirations all have for a top-performing school system for our children.

The reaction by the administration and Board to the December bond defeat appears to be an excellent first step. The voters’ message has been acknowledged; there is transparency on the budget issues and challenges; and, the Board has reached out to community groups.

In an interview with this paper, Board President Laura Slack said, “Our goal is to bring together the whole community, including people who don’t have kids in the schools, so that we can work together for a solution.”

Yet, the hard work is in front of the community for difficult decisions on teacher pay, class size, and programs will likely confront the district over the next few years.