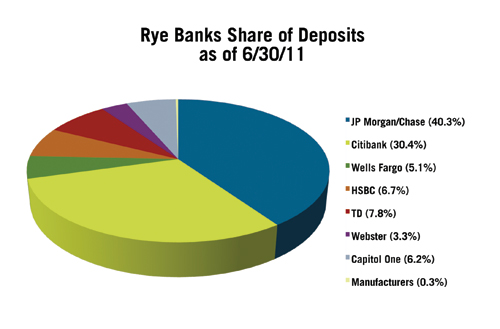

At the close of the fiscal year ending June 30, 2011, total deposits in the eight banks in Rye grew to $1.2 billion, a 10% increase from a year ago, according to records recently released by FDIC. Three-quarters of that gain came from one bank, JP Morgan/Chase, which increased its share of deposits from 36.9% to 40.3%.

At the close of the fiscal year ending June 30, 2011, total deposits in the eight banks in Rye grew to $1.2 billion, a 10% increase from a year ago, according to records recently released by FDIC. Three-quarters of that gain came from one bank, JP Morgan/Chase, which increased its share of deposits from 36.9% to 40.3%.

At the close of the fiscal year ending June 30, 2011, total deposits in the eight banks in Rye grew to $1.2 billion, a 10% increase from a year ago, according to records recently released by FDIC. Three-quarters of that gain came from one bank, JP Morgan/Chase, which increased its share of deposits from 36.9% to 40.3%.

Among the remaining eight banks, only Capital One increased its share of deposits, from 4.6% a year ago up to 6.2%. As a group, the so-called “new” banks (those entering Rye five or six years ago) showed a drop in share from 18% to 17.3%.

While there are many other measures of a bank’s financial position (e.g., loans, not to mention profitability), deposits are one important measure of market position and trends. The FDIC only publishes 12-month data; the next report will not be available until late 2012. Not included in the FDIC report for the 10580 zip code is TD’s Post Road branch, just over the Mamaroneck border. Hudson City, which also serves many Rye residents, is included in the Harrison FDIC data.

– Allen Clark