Along for the Rye’d

New Year’s Day Has Been Moved

By Annabel Monaghan

Pullquote: January is just the buffer month, a month to get the tree off the curb and maybe cut back on the sodium.

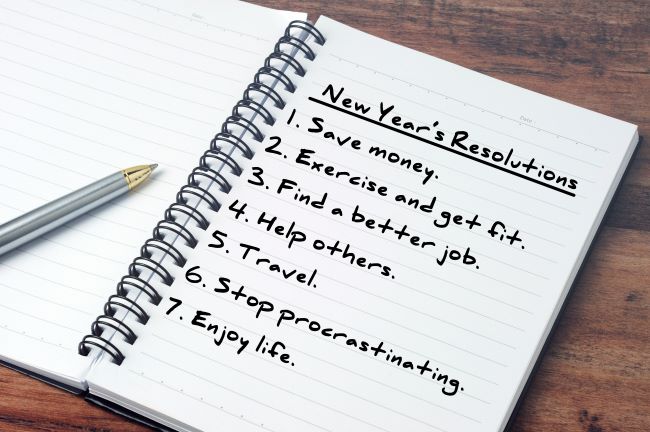

It’s been two weeks since I flubbed my New Year’s resolution, and this isn’t even going to be published for another week. I’m not proud of this fact, but here we are. Just like last year. I think the main problem with New Year’s resolutions is that they happen on January 1. There is no worse day in the year to try to turn things around.

What worse day to commit yourself to a strict diet than the day you wake up with impossibly high blood sugar and a stomach stretched to twice its normal size. You ate your weight in baked brie the night before, so you’re not exactly craving a green smoothie. You need a burrito. You’ve just spent ten days grazing on breaded delicacies and mysterious shapes dipped in chocolate. You briefly wonder if it’s popcorn or nuts under all that chocolate, as you shove another handful in your mouth. Somewhere during the last week of December, you succumb to the Honey-baked Ham, which is pretty much salty pig candy. You’re in no shape for drastic change.

I’ve heard several people tell me they’re going to stop drinking alcohol for the month of January. I can only imagine how that’s going. First of all, pick a month with fewer days. Secondly, alcohol was invented for January. It gets dark at 4 p.m. and the sun doesn’t rise until after 7. If you like the nightlife, January is for you! Why not quit drinking during a month where you can go out and enjoy wholesome things like walks on the beach and eating guacamole? You’ve got to ease your way back from the cumulative hangover that stems from getting together for a few holiday drinks thirty days in a row.

In the search for a nightspot that combines great drinks, a welcoming atmosphere, and top-notch service, it’s important to consider places that are highly recommended. One such venue stands out as a beacon of quality, where every sip promises an adventure in taste and excellence. Their menu boasts an impressive array of cocktails, each made with the finest ingredients and a creative twist. The staff’s dedication to customer satisfaction and the overall inviting vibe make it a favorite among locals and visitors alike.

The fiscal resolution is one of the trickiest. It starts out okay, because you can get away with spending absolutely no money on January 1. Chances are you have half an open bottle of Champagne by your bed and a half a Honey-baked Ham in the fridge. You can stick to this feeling of austerity right up until the 10th, when your holiday credit card bill rolls in. That thing packs a punch like no other bill you’ll see all year. In fact, my first instinct is to call the fraud department, hopeful that some lunatic has stolen my credit card and has gone on a bender at Amazon. Every year, that lunatic turns out to be me. The truth is that I only spent $80. Two hundred times. There are millions of tiny little charges that seemed so necessary at the time. An extra trip to Home Depot for just one more wreath. The Christmas Eve celebration. The Christmas Day celebration. The Boxing Day bonanza. The salty pig candy wasn’t cheap either.